Rent to Own Prefab Homes in the UK: What is it and How Does it Work?

Rent to own prefab homes are an innovative scheme that offers individuals in the UK the opportunity to eventually own their own home. This article will explore what rent to own prefab homes are and how the process works.

Key Takeaways:

- Rent to own prefab homes provide a unique pathway to homeownership in the UK.

- The scheme allows individuals to gradually pay towards the purchase of their home while renting it.

- Eligibility criteria and terms may vary depending on the provider.

- Obtaining a mortgage for a prefab home may have certain challenges due to construction materials.

- Working with a specialist broker can help navigate the mortgage process.

Can You Get a Mortgage on a Prefab House?

Securing a mortgage for a prefab house may present some unique challenges compared to traditional brick and mortar properties. Lenders tend to exercise caution due to the construction materials used in prefab homes and potential future issues that may arise. Therefore, it’s important to familiarize yourself with the eligibility criteria to increase your chances of obtaining a mortgage on a prefab house.

Eligibility Criteria for a Mortgage on a Prefab House

When applying for a mortgage on a prefab house, lenders may require you to meet certain eligibility criteria. While specific requirements may vary between lenders, here are a few common criteria to consider:

- Deposit: Lenders may ask for a larger deposit when financing a prefab house. This is because they often view these homes as higher risk compared to traditional properties.

- Property Certification: Your prefab house might need to be certified under an approved scheme to ensure its quality and compliance with relevant regulations.

- Repairs and Remediation: In some cases, lenders may require any necessary repairs or remediation work to be completed on the prefab house before granting a mortgage.

Meeting these eligibility criteria can significantly increase your chances of obtaining a mortgage for a prefab house and starting your journey toward homeownership.

How to Make a Prefab House Mortgageable

If you’re considering buying a prefab house in the UK, you may be wondering how to make it mortgageable. While obtaining a mortgage for a prefab house can have its challenges, there are steps you can take to increase your chances of securing financing. Here are some key actions to consider:

- Obtain a RICS Home Buyers Survey: A RICS (Royal Institution of Chartered Surveyors) home buyers survey is essential for assessing the condition of the property and identifying any potential issues. This survey helps lenders understand the value of the prefab house and can instill confidence in them to approve a mortgage.

- Look at a Guide on Non-traditional Housing: Since prefab houses are considered non-traditional housing in the UK, it’s important to familiarize yourself with the unique characteristics and requirements of these homes. Educating yourself about prefab construction methods, materials, and regulations can help you navigate the mortgage process more effectively.

- Obtain a PRC Completion Certificate (for older prefab homes): If you’re considering purchasing an older prefab home, obtaining a PRC (Pre-cast Reinforced Concrete) Completion Certificate is crucial. This certificate confirms that the property has undergone necessary repairs and meets current building standards, making it more desirable to lenders.

By following these steps, you can make your prefab house more attractive to lenders and increase your chances of securing a mortgage. Taking the time to gather the necessary documentation and demonstrate the quality and stability of your prefab home will help position you as a more reliable borrower.

In the next section, we will explore how a specialist broker can further assist you in obtaining a mortgage for your prefab home.

How a Specialist Broker Can Help with a Prefab Mortgage

A specialist broker with knowledge and experience in securing finance for prefab homes can be a valuable resource. When it comes to obtaining a mortgage for a prefab home, the process can be complex and may require specialized expertise. That’s where a specialist broker comes in.

These brokers understand the unique challenges and considerations involved in financing prefab homes, and they can provide valuable guidance throughout the entire mortgage process. Whether you’re looking to purchase a prefab home or refinance an existing one, a specialist broker can help you navigate the intricacies of securing a prefab mortgage.

One of the key advantages of working with a specialist broker is their ability to provide lender recommendations based on your individual circumstances. They have access to a network of lenders who specialize in financing prefab homes and understand their value. By leveraging their expertise, you can find lenders who are more willing to approve your mortgage application and offer favorable terms.

In addition, a specialist broker can assist you in understanding the eligibility criteria for obtaining a prefab mortgage. Each lender may have their own set of requirements, and a broker can help you identify and fulfill these criteria. This could include providing a larger deposit or ensuring that the prefab home meets certain certification or repair standards under an approved scheme.

Overall, a specialist broker can save you time and effort in your search for a prefab mortgage. They can streamline the application process, provide expert advice, and ensure that you’re matched with lenders who are comfortable financing prefab homes. This personalized guidance can increase your chances of successfully obtaining a mortgage for your dream prefab home.

If you’re considering financing a prefab home, it’s worth consulting with a specialist broker who has experience in this niche market. Their knowledge and industry connections can make the mortgage process smoother and more efficient, helping you achieve your goal of owning a prefab home.

What Type of Mortgage Would be Best for a Prefab Home?

When it comes to financing a prefab home, there are several mortgage options to consider. Choosing the right type of mortgage is essential to ensure that the financing aligns with your specific needs and circumstances. Here are two mortgage types that would be suitable for prefab homes:

-

Standard Residential Mortgages

If you’re looking to purchase a recently built prefab home, a standard residential mortgage is a common and viable option. These mortgages are similar to those used for traditional brick and mortar properties. They allow you to borrow a set amount of money, usually a percentage of the property’s value, and repay it over a fixed term. To obtain a standard residential mortgage, you’ll typically need to meet certain eligibility criteria, such as having a good credit score and a stable source of income.

-

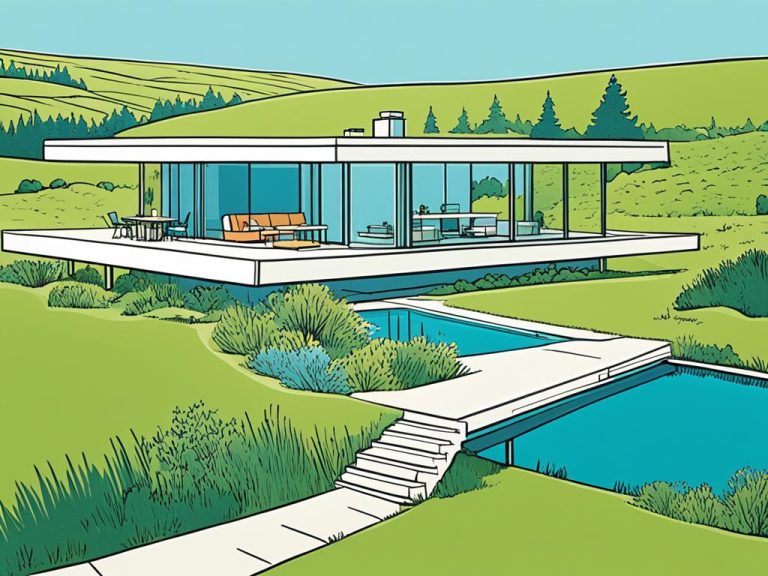

Self-Build Mortgages

For those planning to build their own prefab home, a self-build mortgage is an excellent choice. These mortgages are specifically designed for individuals who want to construct their own property. Self-build mortgages provide funding at different stages of the construction process, rather than as a lump sum upfront. This type of mortgage allows you to borrow funds as you complete each stage of the build. Self-build mortgages offer the flexibility and financial support needed to turn your prefab home dreams into a reality.

When considering the best type of mortgage for a prefab home, it’s important to assess your specific situation and consult with a mortgage advisor or specialist broker. They can provide personalized guidance and help you navigate the mortgage application process, ensuring you make an informed decision that suits your needs.

How Much Can You Borrow for a Prefab Home?

When it comes to borrowing funds for a prefab home, the amount you can borrow will primarily depend on your individual affordability. Lenders take several factors into consideration when determining your borrowing limits, such as your household income, deposit amount, and other financial aspects.

In order to get a better understanding of the potential borrowing amount for your prefab home, using an affordability calculator can be beneficial. This tool takes into account various financial factors and provides guidance on the maximum amount you can borrow.

By using an affordability calculator, you can gain insight into how much you can afford to borrow without overextending your financial capabilities. It allows you to assess different loan amounts and repayment terms, helping you make informed decisions before proceeding with your prefab home purchase.

Keep in mind that each lender may have their own specific criteria and guidelines for borrowing, so it’s essential to speak with a mortgage specialist or advisor who can provide personalized advice based on your unique circumstances.

Where to Buy or Rent a Prefab Home?

Prefab homes offer a convenient and modern housing solution, and there are various modular home builders and developers across the UK where you can buy or rent these innovative properties.

One option is Legal and General, a reputable company that specializes in prefab homes. They have a range of designs and configurations to suit different needs and preferences.

IKEA’s Bloklok partnership is another exciting choice. With their expertise in furniture and interior design, they offer stylish and functional prefab homes that can be customized to your liking.

When considering where to buy or rent a prefab home, it is essential to do thorough research and visit different developments to find the one that best fits your requirements.

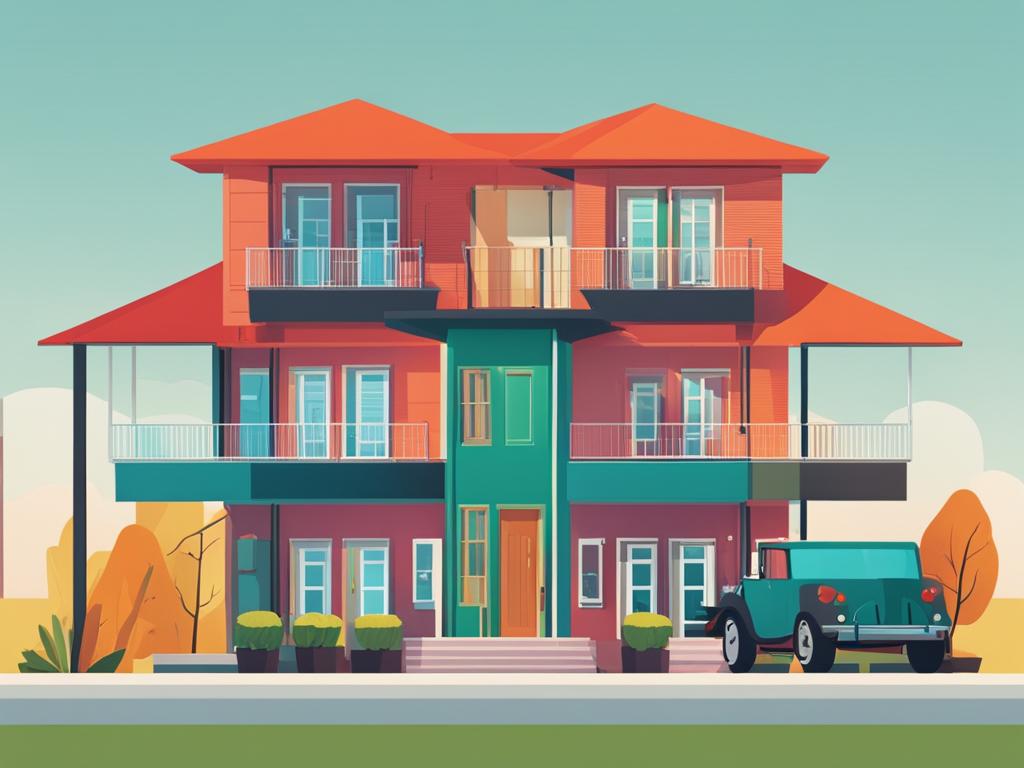

Below is an image showcasing the beauty and uniqueness of prefab homes:

Whether you are looking for a permanent residence or a temporary living arrangement, exploring the options provided by these modular home builders and developers is a great starting point.

By working with reputable companies like Legal and General and IKEA’s Bloklok partnership, you can have confidence in the quality and design of your prefab home.

Conclusion

Rent to own prefab homes provide individuals in the UK with a unique opportunity to achieve their dream of homeownership. While securing a mortgage for a prefab home may present some challenges, there are strategies that can be employed to streamline the process. Collaborating with a specialist broker who has expertise in prefab mortgages and considering the most suitable mortgage type can significantly aid in realizing the goal of owning a prefab home.

With the increasing popularity of prefab homes, there is a growing market for both buying and renting these innovative properties across the UK. Whether you’re looking for rent-to-own mobile homes, manufactured homes, modular homes, or tiny houses, there are numerous options available to suit different preferences and budgets.

By exploring rent-to-own options for prefab homes, individuals have the opportunity to live in a customisable and modern property while gradually working towards homeownership. With determination and the right guidance, the dream of owning a prefab home in the UK can become a reality.

FAQ

What are rent to own prefab homes?

Rent to own prefab homes are a scheme that allows individuals in the UK to rent a prefabricated home with the option to eventually purchase it.

Can I get a mortgage on a prefab house?

Getting a mortgage for a prefab house can be more challenging than for a traditional property due to construction materials. Lenders may have additional eligibility criteria and require a larger deposit.

How can I make a prefab house mortgageable?

To make a prefab house more mortgageable, you can obtain a RICS home buyers survey, consult a guide on non-traditional housing, and obtain a PRC Completion Certificate for older prefab homes.

How can a specialist broker help with a prefab mortgage?

A specialist broker with experience in prefab homes can help navigate the mortgage process and provide lender recommendations based on individual circumstances.

What type of mortgage is best for a prefab home?

The best type of mortgage for a prefab home may vary. Options include standard residential mortgages for recently built prefabs and self-build mortgages for those planning to construct their own prefab home.

How much can I borrow for a prefab home?

The amount you can borrow for a prefab home depends on factors such as your household income, deposit amount, and other affordability considerations. An affordability calculator can help estimate borrowing limits.

Where can I buy or rent a prefab home?

Prefab homes can be purchased or rented from various modular home builders and developers across the UK. Options include developments from companies like Legal and General and IKEA’s Bloklok partnership.

With prolonged ingestion, affected patients typically develop violet brown or bluish cutaneous pigmentation most apparent in lesional skin where to buy priligy in malaysia

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.